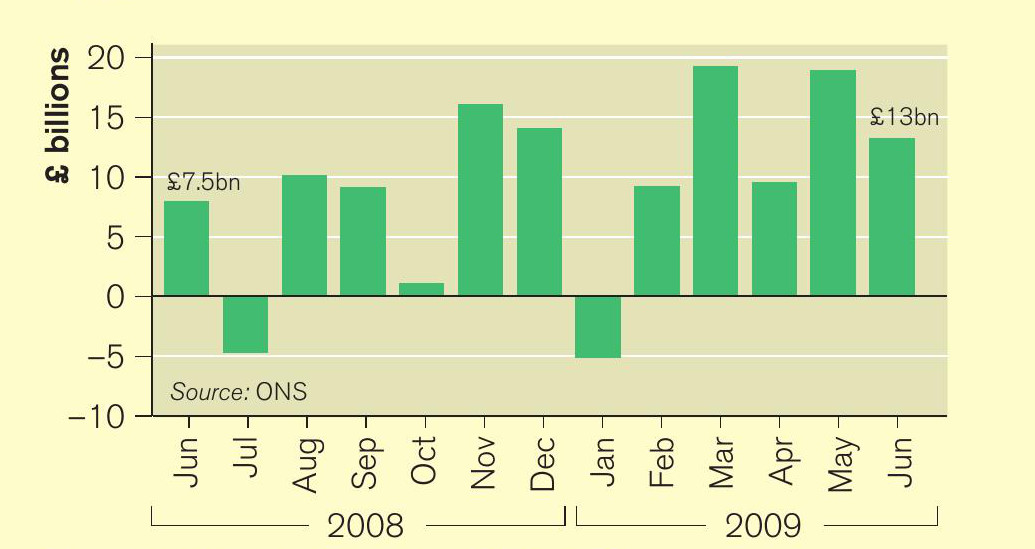

The budget deficit represents government borrowing: the excess of what the government spends — on providing health, defence and education for instance, as well as on benefits and pensions — relative to what it earns, largely in taxation. The size of the budget deficit has exploded over the past year, as shown by Figure 1, which records monthly borrowing. The annual budget deficit in 2008/09 was £90bn: higher than the chancellor forecast and easily the largest total on record. It is predicted that the deficit will rise further to a massive £175bn in 2009/10.

Since the beginning of 2008, the UK has been in a recession. This means that the amount of economic activity in the UK, sometimes referred to as the gross domestic product (GDP), has fallen: we have been producing fewer goods and services (Figure 2). To boost economic activity and so lessen the recession, the government increased its spending and temporarily reduced the rate of VAT to 15% from 17 ½% in November 2008. This ‘fiscal boost’, as it is called, involved an increase in government borrowing, but from the end of November 2008 the recession deepened (see Figure 2).

Your organisation does not have access to this article.

Sign up today to give your students the edge they need to achieve their best grades with subject expertise

Subscribe