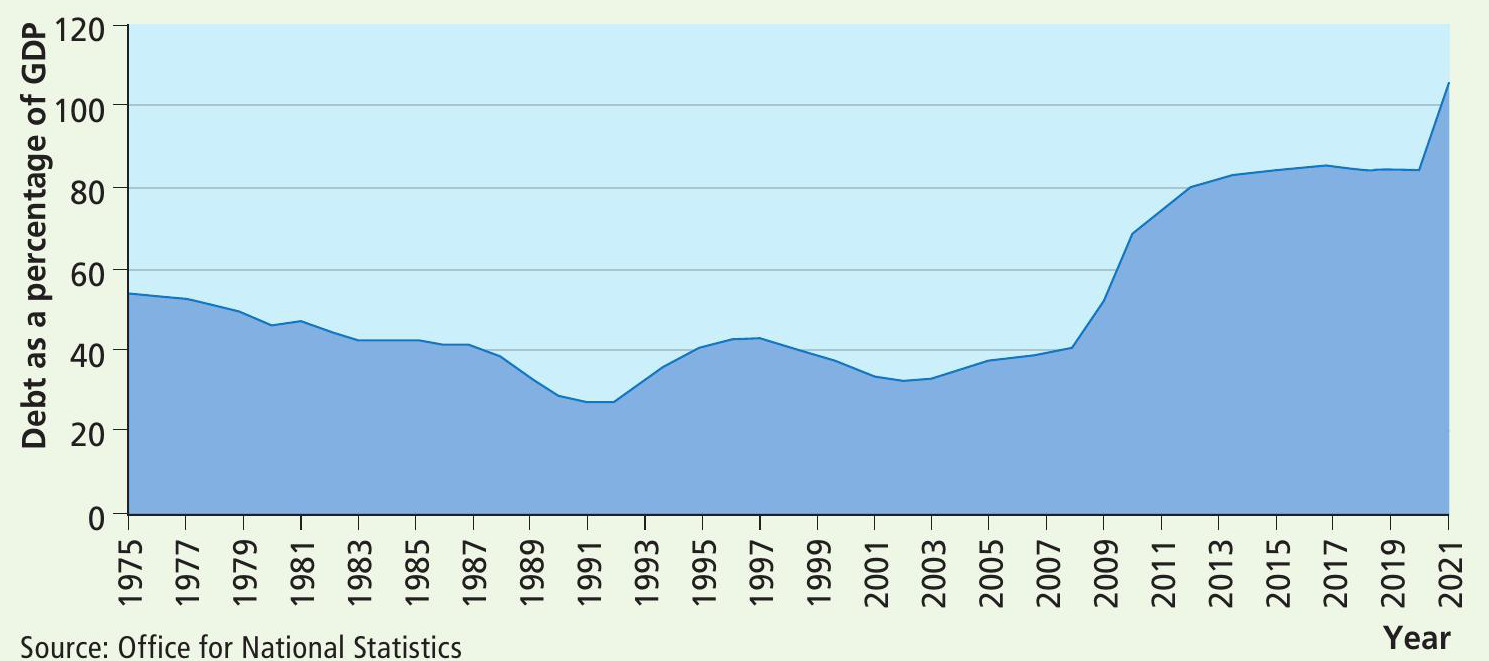

The national debt arises when the government runs what is called a budget deficit. Budget deficits occur when the money the government receives from taxes falls short of the amount spent on goods and services like healthcare and defence, for example. To finance the deficit, the government therefore must borrow (by issuing treasury securities), and this then adds to the national debt. So, in a sense, the budget deficits act like a flow into the stock of national debt.

The distinction between ‘stocks’ and ‘flows’ is very important conceptually in economics. The government’s main creditor is the domestic private sector, which includes insurance and pension funds. They like to own the government’s debt because it offers a predictable return and is very safe — it is extremely unlikely that the UK government will default on its debt.

Your organisation does not have access to this article.

Sign up today to give your students the edge they need to achieve their best grades with subject expertise

Subscribe